题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A provision for loan loss results in less net income for a bank on a bank's income stateme

A.True

B.False

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.True

B.False

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“A provision for loan loss resu…”相关的问题

更多“A provision for loan loss resu…”相关的问题

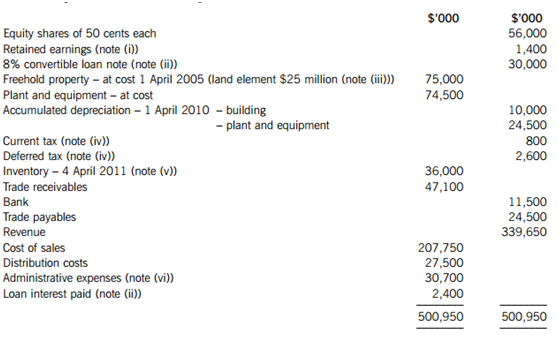

The following trial balance relates to Highwood at 31 March 2011:

The following notes are relevant:

(i) An equity dividend of 5 cents per share was paid in November 2010 and charged to retained earnings.

(ii) The 8% $30 million convertible loan note was issued on 1 April 2010 at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2013 or convertible into equity shares at the option of the loan note holders on the basis of 30 equity shares for each $100 of loan note. Highwood’s finance director has calculated that to issue an equivalent loan note without the conversion rights it would have to pay an interest rate of 10% per annum to attract investors.

The present value of $1 receivable at the end of each year, based on discount rates of 8% and 10% are:

(iii) Non-current assets:

On 1 April 2010 Highwood decided for the first time to value its freehold property at its current value. A qualified property valuer reported that the market value of the freehold property on this date was $80 million, of which $30 million related to the land. At this date the remaining estimated life of the property was 20 years. Highwood does not make a transfer to retained earnings in respect of excess depreciation on the revaluation of its assets.

Plant is depreciated at 20% per annum on the reducing balance method.

All depreciation of non-current assets is charged to cost of sales.

(iv) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2010. The required provision for income tax for the year ended 31 March 2011 is $19·4 million. The difference between the carrying amounts of the net assets of Highwood (including the revaluation of the property in note (iii) above) and their (lower) tax base at 31 March 2011 is $27 million. Highwood’s rate of income tax is 25%.

(v) The inventory of Highwood was not counted until 4 April 2011 due to operational reasons. At this date its value at cost was $36 million and this figure has been used in the cost of sales calculation above. Between the year end of 31 March 2011 and 4 April 2011, Highwood received a delivery of goods at a cost of $2·7 million and made sales of $7·8 million at a mark-up on cost of 30%. Neither the goods delivered nor the sales made in this period were included in Highwood’s purchases (as part of cost of sales) or revenue in the above trial balance.

(vi) On 31 March 2011 Highwood factored (sold) trade receivables with a book value of $10 million to Easyfinance. Highwood received an immediate payment of $8·7 million and will pay Easyfinance 2% per month on any uncollected balances. Any of the factored receivables outstanding after six months will be refunded to Easyfinance. Highwood has derecognised the receivables and charged $1·3 million to administrative expenses. If Highwood had not factored these receivables it would have made an allowance of $600,000 against them.

Required:

(i) Prepare the statement of comprehensive income for Highwood for the year ended 31 March 2011;

(ii) Prepare the statement of changes in equity for Highwood for the year ended 31 March 2011;

(iii) Prepare the statement of financial position of Highwood as at 31 March 2011.

Note: your answers and workings should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(i) 11 marks

(ii) 4 marks

(iii) 10 marks

根据下面内容,回答题

The Bank with Ideas

With several hundred years of history behind it, the APL Bank has few problems in (0)....B......businesses that it is a reputable and secure (19)......of a range of banking services.Now, it is demonstrating to business customers that it is flexible and responsive enough .to(20) ......their changing needs in the 21st century.

Based in London, APL offers banking services to businesses throughout the UK via its branch (21)......Most customer service provision is (22).....out by personal account managers based in local branches, together with (23).....staff at company headquarters.An important (24)...... for APL has been to make it easy for customers to (25)......business with the bank.They can contact their account manager by direct line or email; if the manager is on holiday, a carefully chosen colleague becomes the "account contact" and(26)...... with the customer during the manager"s (27)...... In addition, for those who want (28).....to their bank at any time of day or night there is now a 24-hour phone-based service.

In order to remain competitive and build customer loyalty, the bank guarantees to turn around urgent loan (29)...... within 24 hours.This focus on the customer has also been a driving(30)..... in APL"s recruitment and development policy.For example, newly inducted staff(31)......a "customer service review" to find out what it is like to be on the other side of the desk, asking to borrow money.Together, these (32)......in banking have achieved excellent results.The customer(33)......is growing fast, and last year the bank gained 36,000 new business accounts.

(19)应选 查看材料

A.producer

B.supplier

C.provider

D.giver

•Read the article below about a bank with a reputation for excellence.

•Choose the best word or phrase to fill each gap from A, B, C or D on the opposite page.

•For each question (19-33), mark one letter (A, B, C or D) on your Answer Sheet.

The bank with ideas

with several hundred years of history behind it, the APL Bank has few problems in convincing businesses that it is a reputable and secure (19) of a range of banking services. Now, it is demonstrating to business customers that it is flexible and responsive enough to (20) their changing needs in the 21st century.

Based in London, APL offers banking services to businesses throughout the UK via its branch (21) . Most customer service provision is (22) out by personal account managers based in local branches, together with (23) staff at company headquarters.

An important (24) for APL has been to make it easy for customers to (25) business with the bank. They can contact their account manager by direct line or email; if the manager is on holiday, a carefully chosen colleague becomes the 'account contact' and (26) with the customer during the manager's (27) . In addition, for those who want (28) to their bank at any time of day or night there is now a 24-h0ur phone-based service.

In order to remain competitive and build customer loyalty, the bank guarantees to turn around urgent loan (29) within 24 hours. This focus on the customer has also been a driving (30) in APL's recruitment and development policy. For example, newly inducted staff (31) a 'customer service review' to find out what it is like to be on the other side of the desk, asking to borrow money.

Together, these (32) in banking have achieved excellent results. The customer (33) is growing fast, and last year the bank gained 36,000 new business accounts.

(19)

A.producer

B.supplier

C.provider

D.giver

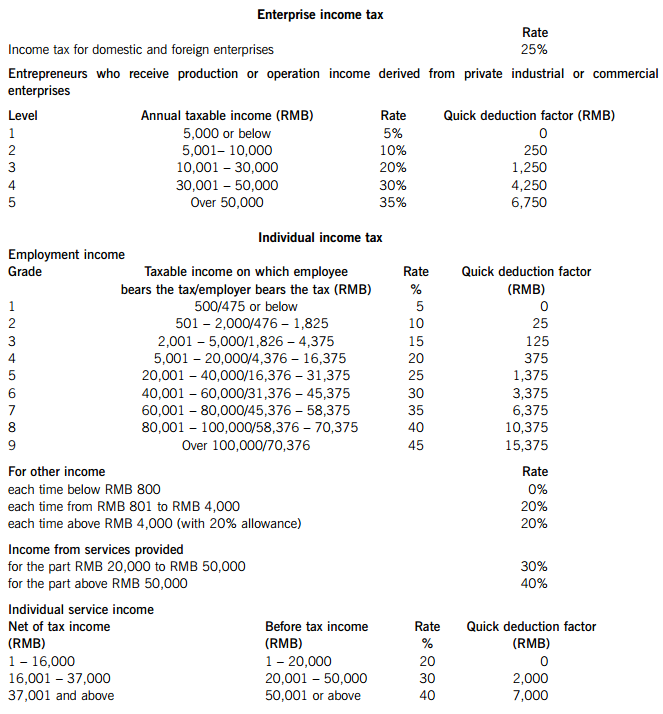

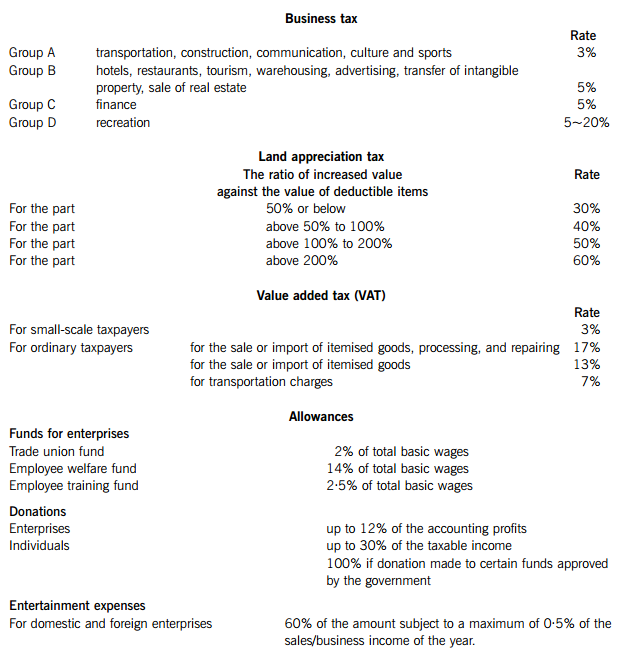

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. Apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

(a) The following is the statement of enterprise income tax (EIT) payable prepared by the accountant of Company P for the year 2010:

Notes:

(1) The union has not yet been set up and the expense is a general provision.

(2) The original cost of the fixed asset was RMB 150,000 and the accumulated depreciation was RMB 105,000, while the accumulated tax allowances claimed were RMB 120,000.

(3) The creditor had been liquidated three years ago.

(4) Last year (2009) was the first year a debtors provision was made. A general provision of RMB 500,000 was made but the whole amount was disallowed by the tax bureau. This year the management decided to write back part of provision amounting to RMB 150,000.

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 12 items marked with an asterisk (*) in the income tax calculation sheet; (17 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company P for the year 2010. (6 marks)

(b) Briefly explain the term ‘arm’s length principle’ in the context of transactions between associated enterprises pursuant to the enterprise income tax law, together with the adjustment methods that may be used by the tax bureau in cases where this principle is not complied with. (6 marks)

(c) Company C, a limited company with equity of RMB 1,000,000, borrowed two loans from related companies:

– RMB 1,000,000 at a 7% annual interest rate from Company A; and

– RMB 2,000,000 at an 8% annual interest rate from Company B.

The market interest rate for the equivalent loans is a 6% annual interest rate.

In 2010, the interest paid to Company A and Company B was RMB 70,000 and RMB 160,000 respectively. The total amount of interest of RMB 230,000 was allocated RMB 140,000 to interest expense and RMB 90,000 to construction in progress in Company C’s accounts.

Required:

Calculate the amount of interest that will be disallowed for enterprise income tax under each of the account headings: interest expense and construction in progress. (6 marks)

2.

(a) Mr Y, a local Chinese national, a professional writer and artist, had the following income during 2010:

(1) Received income of RMB 45,000 for publishing the first edition of a book, and of RMB 15,000 for the second edition of the same book. The book was also published in a newspaper and he was paid RMB 5,250 for this.

(2) Sold one of his paintings for RMB 5,400.

(3) Gave a speech and was paid RMB 28,500.

(4) Acted as a translator for a movie and was paid RMB 60,000.

(5) Gave a speech in overseas country M and was paid the gross equivalent of RMB 27,000, from which the equivalent of RMB 6,750 in overseas tax was deducted at source.

(6) Sold one of his paintings in overseas country H, and was paid the gross equivalent of RMB 15,000, from which the equivalent of RMB 2,250 in overseas tax was deducted at source.

(7) Received interest of RMB 7,500 on a loan he had made to a domestic enterprise.

Required:

(i) Calculate the individual income tax (IIT) payable by Mr Y in respect of each of the items (1) to (7); (12 marks)

(ii) State how and when any IIT due on Mr Y&39;s overseas income will be reported and paid. (3 marks)

(b)

(i) State when a withholding agent must report and pay the individual income tax (IIT) deducted on a monthly basis from employment income; (1 mark)

(ii) List ANY FOUR situations in which an individual taxpayer needs to do self-reporting for IIT purposes. (4 marks)

3.

(a) Enterprise G, a general value added tax payer incorporated in Shenzhen for more than 20 years, had the following transactions in the month of May 2010. Some of the enterprises sales are subject to the standard value added tax (VAT) rate, while others are exempt (VAT) activities. All figures are stated including any applicable VAT:

(1) Sold product A (a standard VAT rate item) for RMB 400,000 and product B (a VAT exempt item) for RMB 350,000.

(2) In addition to the sales in (1) above, distributed product A with a market value of RMB 20,000 for staff welfare benefit.

(3) Purchased RMB 500,000 production materials, of which RMB 50,000 was used for a self-constructed building.

(4) Purchased RMB 200,000 agriculture product, of which RMB 20,000 was used for staff welfare benefit.

(5) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise G for the month of May 2010. (7 marks)

(b) Enterprise H, a small-scale value added tax payer, had the following transactions in the month of May 2010. All figures are stated including VAT:

(1) Sold product for RMB 20,000.

(2) Purchased RMB 500,000 of production materials.

(3) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise H on each of the above transactions, giving brief explanations of their treatment. (4 marks)

(c) Company X, a property developer, had the following transactions in 2010:

(1) Donated a new building to a high school. The cost of construction of the building was RMB 500,000 and the deemed profit rate is 10%.

(2) Contributed an office building as part of a capital contribution. The cost of the building was RMB 600,000 and the market value RMB 800,000.

(3) Sold an equity holding of unlisted stock for RMB 900,000. The equity holding had been obtained by the contribution of a factory building by Company X which had cost RMB 300,000.

(4) Obtained a six-month bank loan of RMB 2,000,000 from 1 July 2010 with the pledge of a shop owned by the company. During the loan period, the bank did not charge any interest, but instead the bank had the right to use the shop rent free. The market interest rate for a similar loan is 6% per year. At the end of the loan period, Company X sold the shop for a price which gave it RMB 1,000,000 more than the amount needed to repay the bank loan.

Required:

Calculate the business tax (BT) payable by Company X as a result of each of the above transactions (1) to (4), giving brief explanations of their treatment. (6 marks)

(d) State the THREE conditions that must be met for a transportation fee paid by the seller to be excluded from the sale consideration for the purposes of value added tax (VAT). (3 marks)

4.

(a) Company K carried out the following transactions:

(1) Imported a vehicle costing RMB 300,000 and paid transportation costs of USD 10,000 for the journey from the overseas supplier to the port in China.

(2) Shipped a machine with a value of RMB 500,000 overseas for repair and paid for materials of USD 10,000 and a repairing fee of USD 30,000. The machine was shipped back to China in the same month.

(3) Subcontracted some domestic raw materials valued at RMB 200,000 to an overseas company. The related fee and transportation costs were USD 100,000 and USD 20,000 respectively.

(4) Imported raw materials costing RMB 30,000,000 and paid transportation costs of USD 50,000 for the journey from the overseas supplier to the port in China. After the arrival of the materials, Company K discovered that 20% of the materials had a quality problem. The supplier agreed to ship a further 20% replacement materials at no cost to Company K in the same month. Both parties agreed that the quality problem goods should be kept in China.

Required:

Calculate the customs tariff, consumption tax (CT) and value added tax (VAT) payable by Company K as a result of each of the above transactions.

Note: for the purposes of your calculations you should assume that:

(1) The customs tariff for all kinds of imported goods is 20%.

(2) The rate of consumption tax (CT) is 10%.

(3) The USD:RMB exchange rate is 1:6·6

(b) Briefly explain the procedures, including any time limits, for the declaration and payment of the customs

5.

Briefly explain the consequences of the following actions, including any fines or other penalty that may be imposed:

(a) Failure to keep or maintain proper accounting records/vouchers. (2 marks)

(b) Failure to file a return within the prescribed time limit. (2 marks)

(c) Failure to file a return and hence not paying or paying less tax than is duly payable. (1 mark)

(d) Failure to pay tax by concealment of property. (3 marks)

(e) Refusal to pay tax by violence or menace. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

America takes the view that, since many developing-country loans will never be repaid, mainly because the recipients(接受者) cannot afford to make large payments to their creditors, it makes more sense to treat them as grants in the first place. The Bush administration has threatened to hold up the provision of the funds used for this sort of aid, International Development Assistance(IDA). if it cannot persuade everyone else to come onboard. All members talked about having made progress in this area, but it remains a stumbling block.

Work is also under way in the IMF and the G7 to reform. the international financial system. This now has two objectives. One is to make it harder for terrorist organizations to obtain funding by cracking down on money-laundering and increasing financial transparency. The other is to reduce the occurrence and severity of financial crises in emerging-market countries. On this, American views seem to have prevailed. The G7 meeting on April 19th and 20th ended with an unexpected decision to proceed with an American plan to include collective action clauses in future loans taken out by emerging-market governments. The idea is that in the event of a delay of payment-such as that by Argentina last December—a government could negotiate with a "super-majority" of its creditors to restructure its debts, rather than, as now, have a small minority of creditors able to weaken such attempts.

This market-based approach is still controversial, and implementing it could be difficult given the previous reluctance of governments to include such clauses in loan contracts(lest they appear to be signaling a readiness to default(拖欠) even as they borrow). Work on IMF. plans for more far-reaching reforms of supreme debt, on which the Bush team recently appeared to pour cold water, is to proceed at the same time. The two approaches, said the G7, are "complementary".

According to the passage, America favors moving from loans to grants on the purpose of ______.

A.making more money for the donors

B.relieving debt of the poorest countries

C.solving the problem of poverty completely

D.collecting more money for future aid to other countries

America takes the view that, since many developing-country loans will never be repaid, main- ly because the recipients (接受者)cannot afford to make large payments to their creditors, it makes more sense to treat them as grants in the first place. The Bush administration has threatened to hold up the provision of the funds used for this sort of aid, International Development Assistance(IDA), if it cannot persuade everyone else to come on board. All members talked about having made progress in this area, but it remains a stumbling block.

Work is also under way in the IMF and the G7 to reform. the international financial system. This now has two objectives. One is to make it harder for terrorist organizations to obtain funding by cracking down on money laundering and increasing financial transparency. The other is to reduce the occurrence and severity of financial crises in emerging-market countries. On this, American views seem to have prevailed. The G7 meeting on April 19th and 20th ended with an unexpected decision to proceed with an American plan to include collective action clauses in future loans taken out by emerging-market governments. The idea is that in the event of a delay of payment -- such as that by Argentina last December -- a government could negotiate with a "super majority" of its creditors to restructure its debts, rather than, as now, have a small minority of creditors able to weaken such attempts.

This market-based approach is still controversial, and implementing it could be difficult given the previous reluctance of governments to include such clauses in loan contracts (lest they appear to be signaling a readiness to default (拖欠) even as they borrow). Work on IMF plans for more far-reaching reforms of supreme debt, on which the Bush team recently appeared to pour cold water, is to proceed at the same time. The two approaches, said the G7, are "complementary".

第27题:According to the passage, America favors moving from loans to grants on the purpose of_________

A.making more money for the donors

B.relieving debt of the poorest countries

C.solving the problem of poverty completely

D.collecting more money for future aid to other countries

A.prediction

B.indication

C.provision

D.forecast

Which of the following provides the most flexibility for the bond issuer?

A. Put provision

B. Call provision

C. Sinking fund provision